Blog: Impact of the cost of living on lone parents and the single elderly

Emma Tominey and James Baraniak from the Department of Economics share this blog on how inflation driven by rising fuel and food bills will increase poverty, especially for lone parent and single elderly households.

By James Baraniak, Research Assistant and Emma Tominey, Professor of Economics, Department of Economics, University of York.

The cost of living crisis has seen prices of essentials goods and services escalating. Single adult households including lone parents and elderly spend over 50 percent of their total income on these essentials and have faced effective inflation rates of over 13.5 percent. Inflation driven by rising fuel and food bills will increase poverty especially for lone parent and single elderly households.

The cost of living is continually in the headlines. We are conscious of spending less and concerned about the rising costs of our energy bills, rents, or mortgages as well as the cost of our next food shop. However, recent price increases will have different consequences for a wide range of households, depending on the proportion of total income they spend on goods such as food or drink and essential services, such as energy.

This is because when the cost of living increases, households with 2+ adult earners can share the higher costs. Lone parents and single adults on the other hand, may be hit disproportionately by an increase in costs as they have no one to share their costs with. This not only makes it more difficult for these households to maintain the same living standards, but they also have fewer resources to fall back on when unexpected shocks occur.

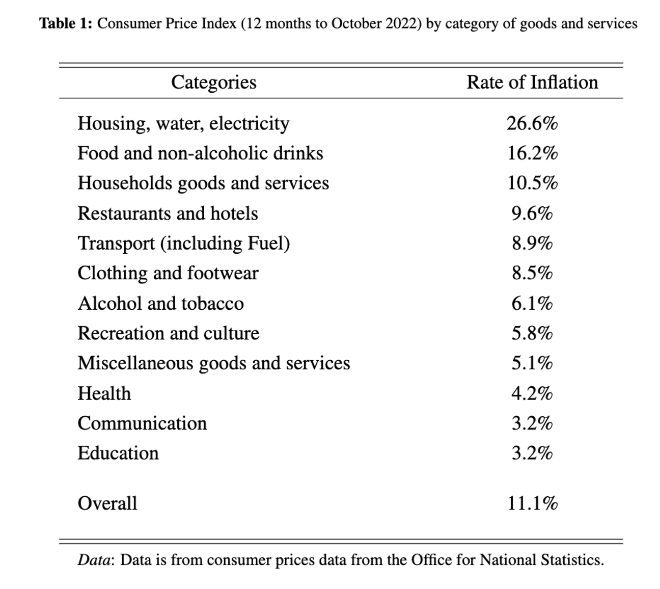

Recent inflation

These recent price increases are reflected in the current consumer price inflation figures published by the Office for National Statistics (ONS) on 16th November 2022. From Table 1, the goods and services that have seen the largest increases in prices over the last 12 months are essentials, including housing (rent, mortgage, electricity, gas), food and drink as well as clothing and other household durables.

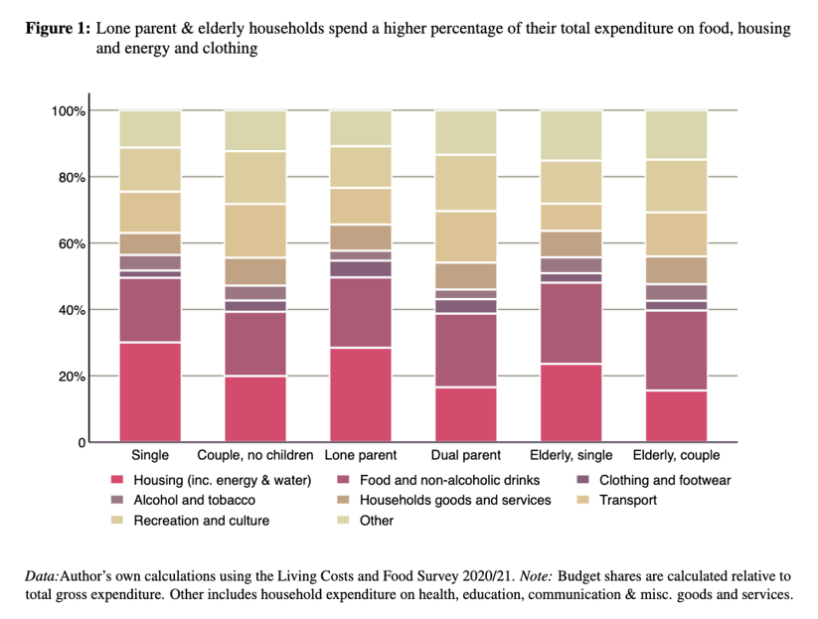

Expenditure shares on essentials and other goods/services

Using the latest data from the Living Costs and Food Survey (LCFS) 2020/21, we can examine household expenditure on different goods and services to see where these price increases will hit households the hardest. Figure 1 shows that lone parent and working age single households devote over 50 percent of their total spending on essentials such as housing, food, and clothing. This is also true for elderly individuals living alone, where these categories make up 48 percent of total weekly expenditure. For dual parent households as well as couples under and over pension age, the above categories count for just over 40 percent of total weekly expenditure.

This means that the increased cost of living may have a larger impact on overall expenditure for the more vulnerable single adult households.

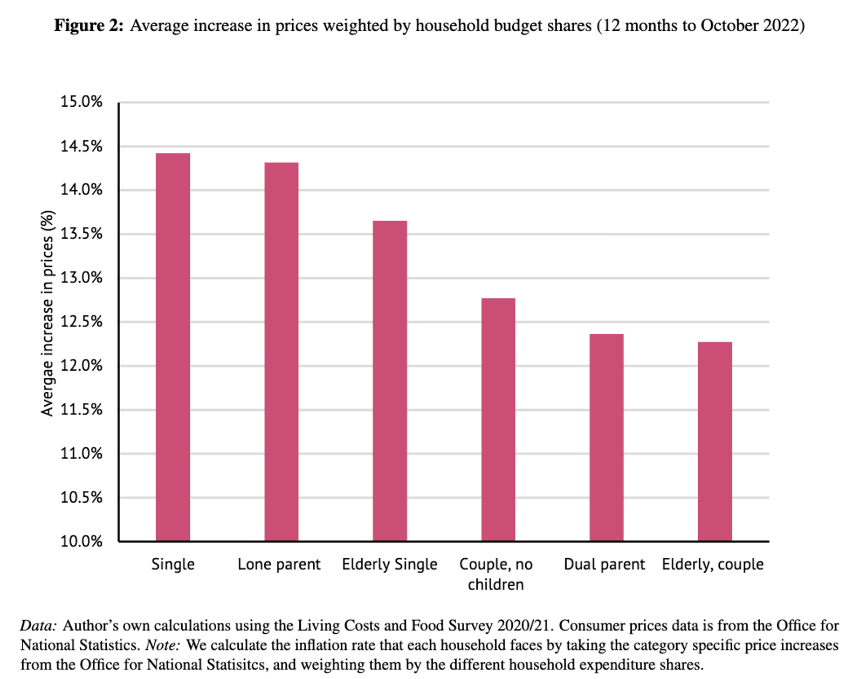

Consequence of inflation on expenditure

How will the rising inflation affect expenditure patterns for the different household types? Figure 2 plots the average increases in costs for each type of household given their expenditure on different goods and services.

Lone parents, single working age individuals and single pension age individuals, are hit disproportionately by the price increases in housing, energy, food and clothing. For couples and dual parent households, transport and recreational costs appear to be driving their high inflation rate.

How will this drive poverty rates?

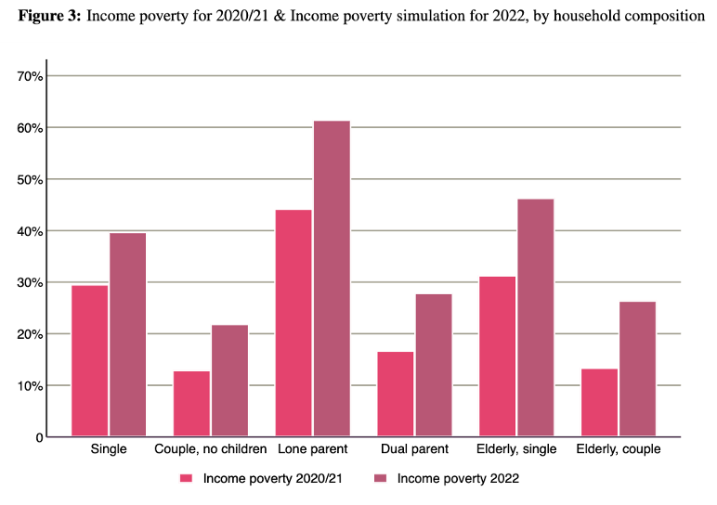

The increased cost of essential goods and services are hitting different households disproportionately. The question now is, what will be the impact of recent price increases on poverty rates?

We can examine the impact of prices on relative income poverty. A household is in relative income poverty if their income is below 60% of the UK median income. We use disposable household income after housing costs (AHC) i.e. rent, mortgage payments, and equivalise income using the OECD modified companion scale.

Figure 3 presents the poverty rates across different household types. In the years 2020/21, lone parents had the highest relative income poverty rate (44.2 percent) among the households considered. Single individuals follow closely behind, both under and over pension age with poverty rates of 29.5 percent and 31.3 percent respectively. Couples without children, dual parents and elderly couples have relatively lower income poverty rates of 12.9 percent, 16.7 percent and 13.4 percent respectively.

The poverty rates are simulated for 2022, assuming that income has remained the same between the two periods. As well as this, we adjust AHC income by deflating the values by the AHC CPI for June 2022 and redefine the relative poverty measure based on a 2020/21 poverty line. Inflation causes a large increase in relative income poverty among all households, but the largest increase has been for the most vulnerable households. Lone parents have the highest income poverty rate (61.5 percent) closely followed by an increase in rates for single adults (39.7 percent) and the single elderly (46.3 percent).

Overall, the recent price increases are eating into the disposable incomes of all households but particularly, lone parents and single individuals both over and under pension age. They simply have less money to buy other goods and services, leaving these households with a smaller proportion of their budgets to deal with further unexpected costs. Even with the Chancellor announcing that the energy price guarantee will be raised to £3,000 from this April (where we also see the end of the energy rebate), an inflation adjustment for benefits and pensions by 10.1 percent alongside a new set of cost-of-living payments, this may not be, or come, soon enough. Winter is here, fuel poverty is on the rise, food bank usage is becoming an unwelcome part of day-to-day life for many. It may be expected that without further intervention, these price increases will continue to squeeze household’s standard of living and more households will continued to be pushed further into poverty.